Plobal Apps helps eCommerce businesses to build their mobile apps in under 5 minutes.

We started Plobal Apps with a core principle that our products should help online stores generate new mobile revenues from their increasingly mobile-first customers. Over the past 18 months, our customers have developed a total of USD 3.5Mn+ in payments, with over 60,000 orders placed exclusively via mobile apps built using Plobal Apps.

Whenever you launch a B2B product, you are faced with the critical decision of what pricing model to choose for your product. There are examples of super successful companies for all models, viz—Free Trial, Freemium, etc.

Before launching our product, we extensively researched the various SaaS pricing models. We finally decided to go ahead with our product’s Free Trial pricing model. We launched our product with three plans at this stage, viz. Starter ($29/mo), Growth ($79/mo), and Power ($99/mo)

As soon as you launch, growth is the only factor every startup looks at. As with every other startup, we have been experimenting with A/B tests, email campaigns, intercom reply rates, and various growth hack to increase our conversion rates. After months of optimization, we had started hitting conversion rates of 15% for our landing pages, 60% open and 10% reply rates for our drip email campaigns, and a lead-to-deal conversion rate of 25%.

All our other efforts beyond these led to incremental growth, not exponential. At this time, we were looking at revising our pricing plans and noticed something. A more detailed analysis of our metrics and feedback from our support teams showed that four factors seemed to be limiting our growth:

Our research said three factors were limiting our growth:

- Our entry-level pricing was too high (now $129)

- Our customers didn’t have sufficient time to benefit from the product

- We were leaving money on the table with our high-performing customers

- Churn was around 8%

We had been gradually increasing our pricing over the last couple of quarters to filter out newer businesses, as we could initially take up only a limited number of demos + support. However, we recently developed new features, free tools, and customer success processes, driving value to even smaller, more unique stores. In any case, we didn’t want to move to a low-cost plan with limited features again. (We’ll tell you why shortly.)

We noticed that majority of the customers that were churning were relatively newer businesses using our Starter plan, and one of the top reasons for churn was low ROI from the mobile App. Ideally, we are not a basic plug-and-play App that starts showing results immediately. Using our product meant adding a new sales channel for your eCommerce store. But we saw a lot of our customers who wouldn’t generate a good ROI from our product would stop using it just after two months.

However, we had seen similar stores at a similar stage start generating revenues post 4 to 5 months and then continue with our platform. So we ideally needed newer stores to stick around for four months, but that meant an investment of approx—$ 500 on their part before they saw any results.

Our discussions with our customer success teams revealed that many features required for these newer, smaller businesses to succeed were ideally available for our more established power plan users. Facebook SDK integration to run App Install ads, targeted push notifications, and abandoned cart push notifications, but not for our Starter plan users. Now, this is standard across most SaaS products with multiple pricing plans, be it B2B or B2C, that you have the best value add features locked for your higher-priced plans.

This essentially meant our pricing plans were blocking our customers from making more money, resulting in faster churn. We analyzed quite a few companies and saw this was true in most cases.

Let’s take an example of Tinder:

The core value proposition for Tinder is to help their users to get matches. Once the user starts getting games, his stickiness with the App is very high.

However, all the features that would help Tinder’s users get more matches, viz., swipe around the world, unlimited swipes, boost profile, etc., are locked for their paid users. This sounds fair. But we feel this goes against the core value proposition of Tinder.

On thinking more about this, we realized that there was a bigger problem. Like Tinder and thousands of other SaaS companies, our pricing plans weren’t aligned with our core value proposition, which, for us, was to enable businesses to generate new revenues from mobile.

This was when we revisited all the SaaS pricing models. And we came up with something interesting. We call it Freemium 2.0 / (TCVP), The Core Value Proposition pricing model.

Freemium 2.0

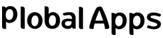

We are essentially giving the fully loaded version of our apps for free to all our customers, with the condition that they start paying when the product delivers on its core value proposition, which in our case is once they start making revenues from their mobile App.

And as the business makes more money from its mobile App, we move them to a higher pricing plan (capped at $299/mo as per our original pricing plan).

This is how our new pricing model looks:

We hypothesize that this will result in the following:

- More businesses will sign up as we have removed the high price entry barrier, and the pricing is highly results-oriented and based on a powerful value proposition

- Churn will reduce drastically, as only the businesses making money are becoming paid customers. Our churn for customers who make good ROI is less than 1%

- Customers will get more time to activate and optimize their business/apps, which, in some cases, is required for the channel to start working.

- We will not leave money on the table as pricing is correlated with performance.

Freemium 2.0 for Tinder:

Now imagine the same pricing model for Tinder. You start paying once you get x matches. But till you get to those X matches, you have access to all the features which will help you get more games. As you have access to features that aid in getting a game, your probability of getting a game will be higher. And since Tinder has delivered on its core value proposition, the App’s stickiness will be much higher with a higher number of paying customers.

Things we are accounting for:

-

With this new plan, we expect more inquiries and demos for our product. We are implementing a lead-scoring mechanism to ensure high-quality leads aren’t missed.

-

The onboarding and support volume is going to increase. We have added a new onboarding flow and a FAQs knowledge base to tackle this with our current team size.

-

The buy-in for businesses is going to be lesser as it is for free products. We are incorporating a few strategies to combat this.

We are running this as a 3-month experiment that was started on the 1st of September. We will publish part 2 of this in the coming months with our results.

Share Your Views!